Financial services institutions face particular marketing challenges in today’s ever-evolving digital environment, particularly with regards to marketing their offerings. Online banking, fintech startups, and shifting consumer preferences present unique marketing challenges and opportunities – traditional approaches no longer suffice; financial institutions must embrace digital strategies tailored specifically for their industry if they wish to remain successful in this environment. In this blog post we’ll cover everything digital marketing for financial services involves, including key strategies, best practices and emerging trends.

Understanding the Landscape: Role of Digital Marketing in Financial Services

Consumers today expect instant access to financial products and services, making digital marketing increasingly essential for financial institutions looking to reach and engage with their target audiences effectively. From social media to email campaigns, digital channels provide unparalleled opportunities to connect with consumers while building brand recognition and driving customer acquisition.

Building Trust in a Digital World: The Importance of Trust and Security

One of the biggest challenges financial institutions face in digital marketing is establishing and maintaining consumer trust. With cybersecurity threats mounting and data breaches becoming more prominent than ever, consumers are becoming increasingly wary when sharing financial data online. Therefore, financial marketers must prioritize trust and security as part of their digital marketing initiatives; this may involve employing robust security measures, transparently outlining privacy policies, or using customer testimonials and reviews to bolster credibility.

Personalization and Targeting: Tailoring the Message to Your Audience

Generic marketing messages can easily get lost among all of the noise. To break through and grab consumers’ attention, financial marketers must rely on personalization and targeting in their digital campaigns. By leveraging data analytics and customer segmentation techniques, financial institutions can deliver highly relevant marketing messages directly to specific audience segments – be it product recommendations or tailored emails offers; personalization plays an integral part in driving engagement and conversions in financial services digital marketing.

Content Is King: Informing and Educating Consumers

Financial consumers need guidance and information in order to make sound financial decisions, providing financial institutions an ideal opportunity for becoming trusted advisors by creating valuable and educational content such as blog posts, articles, videos and infographics. Content marketing plays a central role in digital marketing for financial services – creating engaging pieces of work that caters directly to consumer pain points can attract and retain customers while simultaneously building thought leadership within their field of operation.

Engaging Consumers on Their Terms through Social Media

Social media has transformed how we connect and communicate, including in the financial services industry. Platforms such as Facebook, Twitter, LinkedIn and Instagram offer financial institutions unique opportunities to engage consumers, build brand recognition and foster customer loyalty. By posting educational articles or tips as well as soliciting customer service feedback through these channels, financial marketers are able to humanize their brand while forging meaningful relationships with their audience on these channels.

Optimizing for Mobile: Reaching Consumers Where They Are

With most internet users accessing content via mobile devices, optimizing for mobile is now an absolute necessity for financial marketers. From responsive websites and banking apps, to location-based targeting capabilities and push notifications that financial institutions can utilize to send targeted and timely marketing messages directly to customers’ phones.

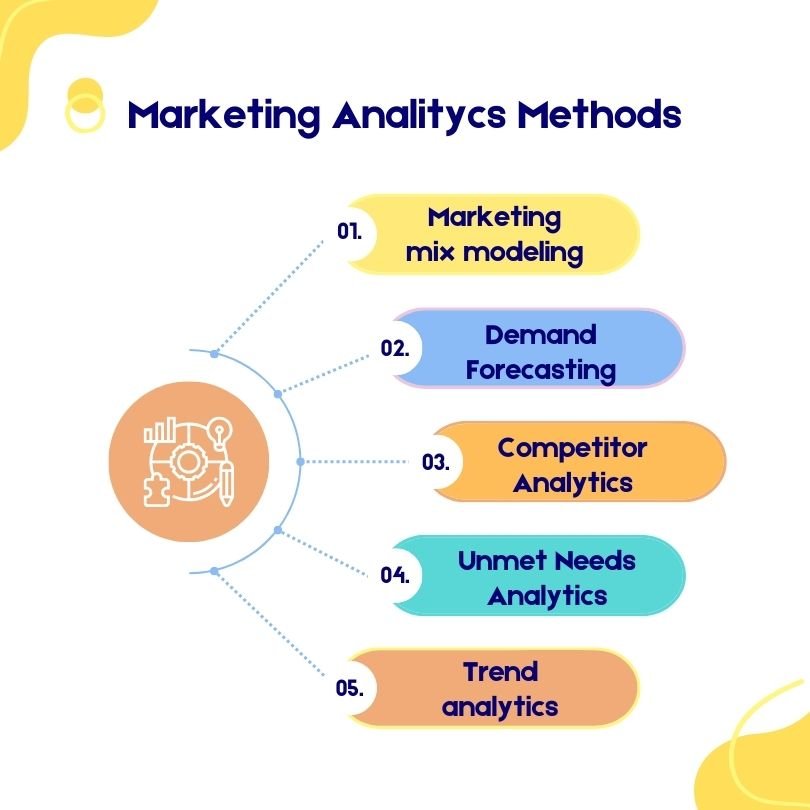

Data-Driven Decision Making: Tapping into the Power of Analytics

Digital data analytics are indispensable tools for financial services institutions. By harnessing analytics to gain valuable intelligence on consumer behavior, preferences, and trends. With such information at their disposal, financial marketers are empowered to make informed decisions, optimize campaigns in real-time, measure return-on-investment metrics of digital marketing efforts – everything from tracking website traffic and conversion rates to social media engagement metrics and email open rates; analytics offers invaluable insight for continuous improvement and innovation in digital marketing for financial services.

Navigating Regulatory Compliance: Balancing Innovation with Compliance

Digital marketing presents many opportunities for innovation and growth; however, financial institutions must navigate a complex regulatory environment to remain compliant with laws and regulations. From GDPR in Europe to CCPA in California, privacy regulations impose stringent requirements on how financial institutions collect, store and use consumer data for marketing purposes. Therefore it’s crucial for financial marketers to collaborate closely with legal and compliance teams in ensuring their digital marketing initiatives meet regulatory requirements as well as industry best practices.

Keeping An Eye Out For Trends and Future Opportunities

As technology continues to advance at an exponential rate, digital marketing for financial services looks bright. From AI-powered chatbots and virtual assistants to blockchain-based marketing platforms, emerging technologies promise to revolutionize how financial institutions engage with consumers and deliver personalized experiences. Furthermore, voice search, augmented reality, and immersive technologies open up new avenues of creativity when it comes to digital marketing for financial services.

Digital marketing has become essential for financial institutions wishing to succeed in today’s digital economy. Through targeted, informative, and engaging digital strategies, financial marketers can connect with consumers, build trust with potential clients, and drive business growth in an otherwise highly-competitive landscape. However, to be truly effective, financial marketers must adopt an aggressive yet strategic approach while being attentive to emerging trends and best practices so as not to fall behind in this area.

Partner with Treehack to Boost Your Digital Marketing Strategy

Treehack stands out as a top digital marketing company, known for their cutting-edge approach and track record of success within the financial services industry. From data driven insights to creative campaign execution, they enable financial institutions to optimize their digital marketing efforts and achieve their business goals using Treehack’s expertise and industry knowhow to stay ahead of the competition and open up new doors of growth in digital.